Section 8 Company

Company registration under Section 8

Submit Your Query

Everyone can help someone, even though we can’t help everyone.

All organisations in India do not solely operate for financial gain. There are certain organisations that dedicate their efforts to charitable and non-profit causes. These groups are typically referred to as non-governmental organisations (NGOs).

A non-profit organisation, or NGO, is one that seeks to advance underprivileged groups in society or to improve society as a whole.

Depending on the activities one wishes to engage in, an NGO may register in India using a variety of formats and function under a variety of laws:

| In the form of | Applicable laws |

|---|---|

| Trust | India Trust,Act,1882 |

| Society | Societiegs Reistration Act, 1860 |

| Section 8 Company | Companies Act,2013 |

The most common type of NGO in India, though, is a Section 8 business. In contrast to a Trust and a Society, a Section 8 Company is simple to set up, operate, and manage.

Trusts and societies are registered in accordance with State Government laws, whereas Section 8 Companies are registered in accordance with regulations of the Ministry of Corporate Affairs.

Who or what is a Section 8 Company?

According to the law, a Section 8 Company is a business that was established and registered with the Ministry of Corporate Affairs of the Central Government with the following goals:

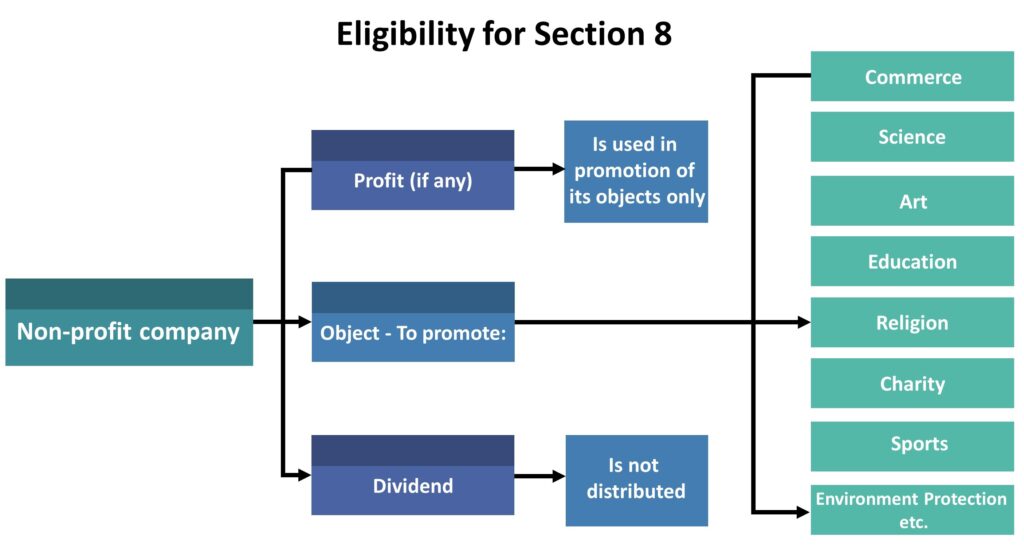

- Promote philanthropic causes in the following areas:

| a. Commerce | f. Research |

| b. Art | g. Social Welfare |

| c. Science | h. Religion |

| d. Sports | i. Charity |

| e. Education | j. Protection of Environment, etc. |

Everyone can help someone, even though we can’t help everyone.

All organisations in India do not solely operate for financial gain. There are certain organisations that dedicate their efforts to charitable and non-profit causes. These groups are typically referred to as non-governmental organisations (NGOs).

- Such a company forbids the payment of any dividend to its members and aims to use its profits to further its objectives.

- The Central Government may give these businesses permission to omit the word “Limited” or “Private Limited.”

- Additionally, the name of a Section 8 company may contain the phrases “foundation,” “forum,” “association,” “federation,” “chambers,” “council,” “electoral trust,” etc.

- A Section 8 Company may be incorporated as either a Private Limited Company or a Public Limited Company and is ideal for non-profit purposes.

- The process of incorporation is almost identical to that of any other company registration in India, except that a prior licence must be obtained from the Central Government (this requirement is relaxed in case of a fresh incorporation, and the licence will be issued along with the certificate of incorporation itself).

- If the company is to be incorporated as a private company, a minimum of two directors are necessary; if the firm is to be incorporated as a public limited company, the minimum number of directors increases to three.

- In the proposed Company, the same person may serve as both a shareholder and a director. Additionally, at least one director must reside in India (i.e. his total period of Stay in India is 182 days or more).

Who is eligible to join the Section 8 Company?

Benefits of Forming a Section 8 Company

There are several significant benefits that a Section 8 firm will experience:

- Benefits with regard to taxes: Since Section 8 corporations are non-profit organisations, they are qualified for a number of tax exemptions and deductions as set forth in the Income Tax Act of 1961.

- Zero Stamp Duty: Section 8 firms are exempt from paying stamp duty on the AOA and MOA of the private or public limited companies, in contrast to other types of businesses. Additionally, little incorporation fees are even imposed.

- High Credibility: Section 8 businesses have a higher level of credibility than other NGOs, such as Trusts or Societies. Since they are approved by the central government, the company’s AOA and MOA cannot be changed without first receiving consent from the central government.

- No Minimum Capital: To establish the firm, a section 8 business only requires a little amount of share capital.

The money from their own subscription fees or public donations can be used directly by the members. - Exemption from the title “Limited”: Contrary to other companies, such as private and public firms, which are required to add “Private Ltd” and “Limited” to the end of their names, Section 8 Companies are exempt from this need.

Issues with Section 8 Companies

Every specific thing has advantages and disadvantages. Therefore, along with the benefits that a Section 08 firm is entitled to, there are also certain drawbacks.

- Amendment in AOA and MOA: The MOA and AOA cannot be amended or changed by a Section 8 Company without the Registrar of Companies’ consent.

- Distribution of Profits Is Prohibited: A section 8 corporation is not permitted to divide its profits among its members or promoters. All earnings must be used to advance the company’s goals.

- Multiple rules and regulations: For section 8 companies, the central government has mandated a number of compliances. The MOA and AOA must contain all norms and regulations.

- Limitations on the Objectives: The main objective of Section 8 corporations is limited to using the company’s income and profits for promoting certain regions as is the company’s objects solely, and not for any other reason.

Steps to Take to Form a Section 8 Company

- Obtain Digital Signature Certificate(DSC):

Since the registration process is entirely online, electronic forms must be digitally signed in order to be utilised. For this reason, it is necessary to obtain Digital Signature certificates for each proposed director and promoter. - Request Name Approval for the “RUN Facility”:

The applicant for the company shall submit the application for reservation of the name of the proposed company in the specified form and shall also abide by the provisions and guidelines established by the Companies Act for name reservation.

(A proposal of two names must be provided in the designated format.)

Note: The company name must be distinct and cannot be the same as or confusingly similar to the name of any other company, LLP, or trademark. - Company incorporation using the new Form SPICE (INC-32):

The application for incorporation of a Section 8 business must be presented in a single, MCA-prescribed form after the firm’s name has been approved.

The following documents must be attached to the form before submission:

| a. Memorandum of Association (in INC-13 form) | f. Declaration from subscribers certifying MOA & AOA |

| b. Article of Association | g. Declaration by Applicant. |

| c. Consent from Directors | |

| d. Declaration from professional certifying MOA & AOA |

Required Documents for Incorporation

- Directors’ and subscribers’ PAN cards.

- AADHAR of subscribers and directors.

- Subscriber and director identification and address proof.

- Subscriber and director identification and address proof.

- Verification of the registered office’s address.

- Utility bill or owner’s NOC.

Note: After receiving the licence provided by the Central Government, an existing company may also submit an application for conversion into a section 8 company. Existing businesses will submit their licence applications in INC-12 Format rather than through the SPICE (INC-32) approach.

License and incorporation certificate granted

The Registrar of Companies issues a licence in INC-16 format along with a Certificate of Incorporation following the verification of all the paperwork.

Benefits of taxes for section 8 companies

NGO/Section 8 Companies are taxed in the same way that other businesses are, which is to say, with a specific percentage of profits. A section 8 firm, on the other hand, qualifies for exemption on “income” and “donations” they receive from inside or outside India.

Why may a Section 8 company claim any tax exemption on its entire income?

Only the public at large and the betterment of society are the goals of Section 8 Company. Additionally, they do not exist for any personal advantage but rather for social purposes. They therefore merit receiving some additional perks in exchange.

As a result, under the terms of the Income Tax Act, a Section 8 Company shall be qualified for exemption from taxes on its income and gifts received from the general public (including international donations).

A Section 8 Company : must get several mandatory registrations in order to claim income tax exemption and accept foreign contributions:

Application for 12A Registration in Form 10A Required Documents:

- A copy of the NGO’s PAN card.

- A complete list of the trustees or members, together with a copy of their PAN and their contact information.

- Copies of the MOA and trust deed that have been notarized.

- Books of Accounts, a Balance Sheet, and an ITR (if applicable), going back three years or more.

- Report on Annual Activity.

Registration pursuant to the 1976 Foreign Contribution (Regulation) Act

- A trust that wants to accept foreign contributions must register under the FCRA Act of 1976.

- On the online portal of FCRA Services, a registration application must be submitted using the prescribed form and supporting materials.

- Documents that must be attached to the form

- Certificate of Trust or Association Registration;

- A copy of the trust deed

- A three-year activity report

- And three-year audited financial statements

- A picture of the Chief Functionary Signatory and the trust’s seal

- Additionally, each important functionary must attach an affidavit .

- A statement and undertaking from the chief functionary.

- It is crucial to get FCRA registration because a nonprofit organisation cannot accept donations from abroad without it.

- An application for such approval must be submitted online at FCRA Services using the appropriate form and supporting documentation.