Payroll

Payroll Services

Submit Your Query

One of the most crucial tasks performed by any organisation is payroll administration. It entails much more than just paying employees’ paychecks. The specific company is in charge of providing payroll administration services for commercial or public enterprises.

Payroll compliance is a broad phrase that refers to the methods used to capture, classify, and summarise information about the company’s human resources and to provide the appropriate reports in accordance with management and legal requirements. The right transaction figures are calculated based on all the pertinent information gathered and further examined.

The timely, accurate, and efficient handling of payroll fosters work satisfaction and employee confidence. It strengthens their commitment and honesty.

On the other hand, inaccurate and unreliable payroll management services have a detrimental effect on employees’ productivity. Consequently, this will have an impact on the company’s standing and stability.

Processing payroll is a difficult, time-consuming task that needs careful planning and execution. Since human resources are the most important resource for every firm, this area needs special attention.

There are only two possibilities remaining for the organisations:

- Create a dedicated HR department to handle all aspects of payroll processing,

- Contract out the task of payroll processing.

Setting up an HR department demands significant expenditure, and occasionally it might be difficult to recruit qualified candidates.

On the other hand, if businesses outsource the payroll processing task, it will not only be less expensive relative to doing it in-house but also include experience.

All payroll services are processed promptly and accurately by India Paramarsh.

Payroll management services

Records & Documentation

- Release of the appointment letter and completion of other joining procedures:

When an employee accepts the job offer from the company, the employer provides him or her with an employee appointment letter.

A payroll processing company must also complete a few more formalities and documentation processes. - Verification of ID and Address as well as Previous Employment:

A Previous Employment Check will be performed on each applicant to confirm their Work History and Experience. This is a fantastic chance for a business to find out more about a candidate and their past employment experience in order to determine whether they would be a benefit to the business.

Similar to that, confirming an applicant’s identity and address verifies that the information they provided on their credentials is accurate and that they genuinely reside at the specified address. - Making of the employee code:

Employee codes are identifying codes given to employees so they can be recognised using the special number given to them. Every employee of the business, including directors, managers, and employees, is subject to the employee code. - Employee ESI/PF registration:

At some point, every organisation must register for PF/ESI. Companies and organisations with more than a certain number of employees are required to register for PF/ESI. - Forms for ESI, PF, and gratuity nominations:

The name of the employee nominee must be listed on a nomination form as well. The form must be submitted using the ESI/PF site.

Payroll Management

- Calculations of salaries based on attendance each month:

The employee’s salary will be determined monthly based on how frequently they show up for work. To determine each employee’s monthly wage, a combined salary and attendance sheet must be kept. - Declaration of Investment and Proof Verification:

Each employer is required to declare their proposed investments for the fiscal year and provide documentation at the end of the fiscal year. The employer is then required to compute tax based on the employee’s investment declaration at the beginning of the fiscal year and deduct average tax each month. - Leave modification:

Every business gives its employees the right to privilege or casual leaves; but, if an employee takes a leave that exceeds their allotted time, that amount must be deducted from their pay. We will maintain records in accordance with corporate regulations and handle deductions as necessary. Each employer is required to declare their proposed investments for the fiscal year and provide documentation at the end of the fiscal year. The employer is then required to compute tax based on the employee’s investment declaration at the beginning of the fiscal year and deduct average tax each month. - Payroll processing and salary processing:

Each month’s salary processing has to be completed by depositing the employee’s net pay into their account. - Pay stubs, tax stubs, and reimbursement slips:

A pay slip or salary slip is a piece of paper given to an employee by their company. It includes a thorough explanation of the employee’s salary components, including Basic, HRA, LTA, and bonuses given, as well as deductions like EPF, ESIC, and reimbursement slips are also provided for each month’s payment of allowance. - Keep a payment register current:

An important record for future reference during labour inspections, audits, and other related processes is a payment register, which is a register including break up-wise information on all employees. - Gratuity being paid in accordance with the Gratuity Act:

When an employee leaves the company, every corporation must adhere to the payment of gratuity act.

After five years of employment with the organisation, an employee is eligible for a gratuity, which is a retirement benefit. - Calculating loan amounts, EMIs, and interest on a regular basis:

If a corporation offers its employees a loan option, the EMI should be immediately taken out of their paycheck each month.

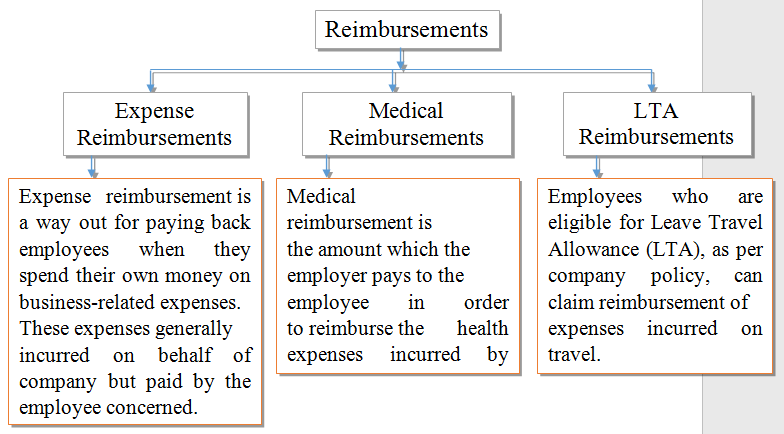

If the loan facility has a reduced interest rate or has no interest, it is considered a perk for the employee and must be subject to TDS withholding under the Income Tax Act. - Cost reimbursement, medical reimbursement, LTA, etc.:

The following expenses are eligible for reimbursement from an employer:

Legislative Compliance

Type 16/12BA:

Employers must provide the Form 16 and Form 12BA certificates to employees who receive salary income. These certificates must include information regarding the employee’s salary, tax withheld at source (TDS), and any benefits received from their employer.

- Deduction and Submission of TDS Returns:

According to income tax regulations, companies are required to withhold average tax from employee paychecks each month and deposit that money by the seventh of the following month.

The company is required to deposit TDS along with interest and penalties if it is not timely deposited with the Income Tax department.

Every employer is required to submit a quarterly TDS return that includes specific information about each employee’s salary paid and TDS deduction therefrom. Employee dissatisfaction will emerge from a mismatch in Forms 16 and 26AS if the corporation fails to complete the TDS return.Additionally, the weight of interest, fines, and fee will increase if TDS returns are filed late. As a result, it is the employer’s duty to ensure that all such compliances are finished on time. - Accurate tax computations:

Every State is free to impose professional taxes, and businesses are required to withhold such taxes from employees and deposit them in state coffers. Since this tax is based on employment, the employee’s salary must reflect this deduction. Since only a few States have implemented professional taxes, it is the obligation of the business to determine their application and comply.

Employment law compliance

Provident Fund Compliance-submission to the PF Department of different monthly and yearly returns:

A mandatory contribution fund for employees’ future is called the Provident Fund (PF). It functions as a corpus fund created by regular, monthly contributions from both the company and the employee.

All employers who have registered for PF are required to file returns each month. Return filing must be finished by the 15th of every month.

On the EPFO Portal, there are also other forms that must be submitted on a monthly or quarterly basis.- ESI Conformity:

In India, a self-supporting social security programme is called Employee State Insurance. To acquire the facilities offered by ESI Corporation, the employer and employee must both contribute a set percentage of their salaries to the fund.

ESI was initially only applicable to factories with ten or more employees. The ESI scheme’s coverage has since been increased.

Currently, ESI registration is required for every industry or firm that employs ten or more people earning up to Rs. 21,000 per month in pay.

The Unified Shram Suvidha Portal is currently the platform that the Government of India introduced for obtaining a Common Registration for EPFO & ESIC.

- Conformity with the minimum wage:

According to the rules of the Minimum Wages Act, all organisations in India are required to pay a specific minimum salary to a specific group of workers or employees, as periodically announced by the Labor Law department.

As a result, it is required of Employers to pay the minimum wages set forth in the Minimum Wages Act.

The Central Government and State Governments each have the power to examine and set the Minimum Wages as well as to enforce the laws against the Employers that fall under their purview.

There are other minimum wage-related compliances that must be followed on a regular basis, such as maintaining a wage register, creating and distributing pay slips, and preparing an annual return in the appropriate format.

- Bonuses are paid for compliance:

Every employee who receives a monthly salary of up to $21,000 is eligible to receive a bonus each year. As a result, each employer is required to identify the qualified employees and pay them bonuses in accordance with the Bonus Payment Act. - Yearly return:

According to labour legislation, every business must submit certain annual reports about the payment of minimum wages, gratuities, maternity benefits, etc.

In order to comply with the obligation, businesses must identify their yearly returns and submit them on time.

Other Conformity

Preparing different challans:

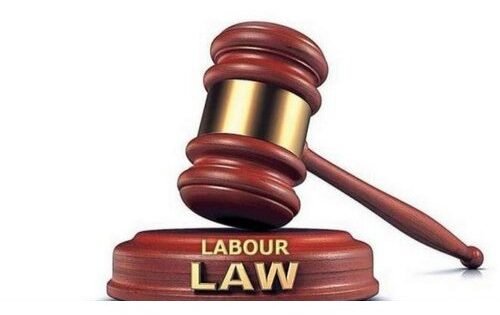

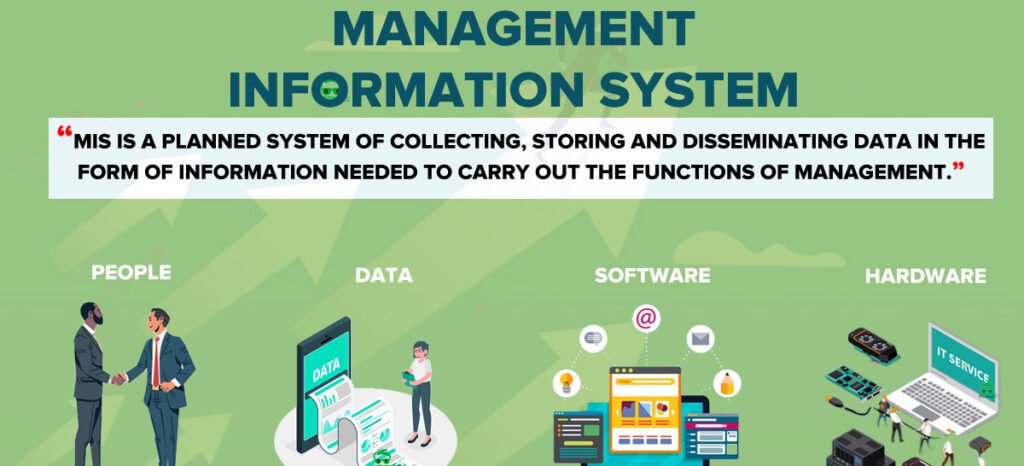

Before submitting any return, it is necessary to create a number of challans connected to income tax, TDS, GST, PF, ESI, and other matters.- MIS and other report generation according to client requirements:

Management Information System is referred to as MIS.

Reports produced by these systems are used by business managers at all levels of a company, from assistant managers to executives, to assess daily business operations or problems that may occur, make choices, and monitor progress.